If you have decided that you want to take care of your own accounts and do your own books – you need to watch out for the pitfalls and acquire some new skills!

Being your own bookkeeper can be very rewarding, save costs and can teach you much about your own business.

Here are our 12 top tips to help you set up and run your business accounts.

1. Subscribe to a proper accounting system

Subscribe to a proper accounting system such as Xero (there are many others but for the purpose of this article we will use Xero) to raise your invoices, record purchases, reconcile your bank accounts and review your profits and loss reports.

For a small monthly fee you can introduce proper systems and controls into your business that grow as you do. Use systems and tools to streamline your processes and make the bookkeeping easier.

Don’t be tempted to use a spreadsheet. You can keep perfectly adequate lists of income and outgoings and with a bit of effort you can reconcile a bank account with a spreadsheet, but you simply can’t create a spreadsheet that can compare with any of the online tools for £10 – £25 per month. If you are serious about your business, and you have a credible business model – set it up and manage it properly from the start.

Don’t skimp on the financial management and control.

2. Learn how to use Xero

The more you learn about the functionality available in Xero – the more efficiency and control you can apply to your business.

The more you learn about the functionality available in Xero – the more efficiency and control you can apply to your business.

Xero has an enormous range of functionality and will grow with you as your business accounting needs become more sophisticated and demanding.

Xero has a great online Help Centre and you can email support with any issues that you might have.

We have a free course that will show you how to use Xero in your business.

[09/10 We are upgrading the course and incorporating video tutorials into each step. The course is LIVE so don’t be surprised if it changes!]

YouTube, Vimeo and the Xero Help Centre are full of free help articles to help you get the best out of the system.

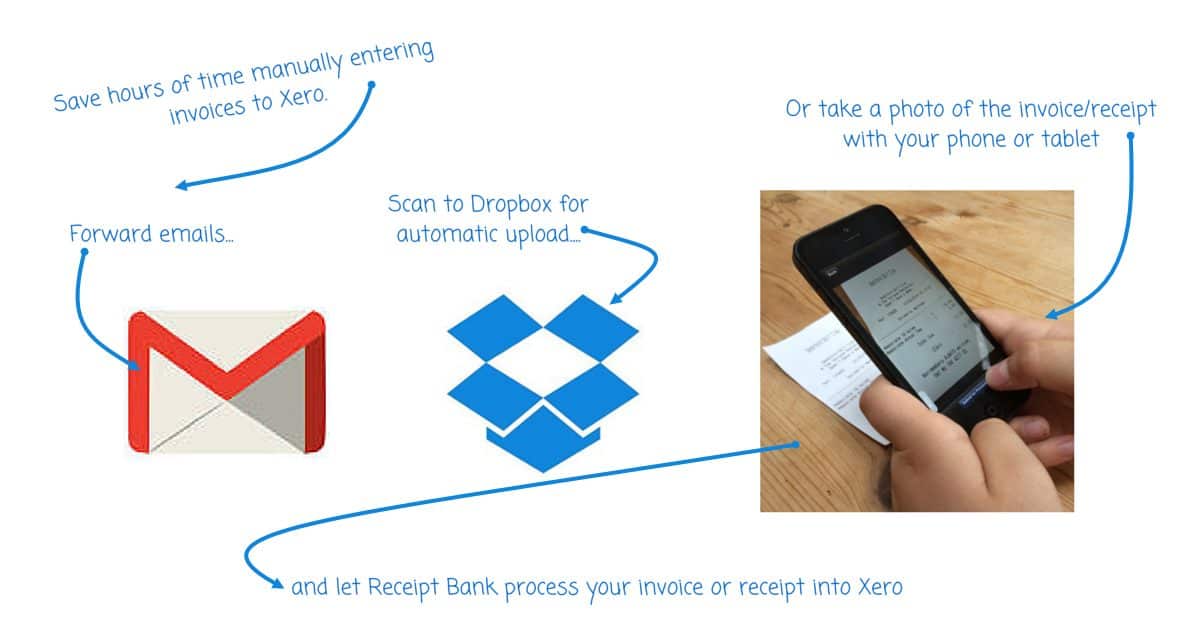

3. Use Receipt Bank to semi-automate your Bookkeeping

If you have more than 10 invoices and receipts a month, I would suggest you use Receipt Bank to push your invoices and receipts into Xero.

Easy to use, Receipt Bank takes the hassle out of manual data entry. You set Receipt Bank to publish your receipts and invoices to the Purchase Ledger in Xero as ‘draft’ documents so you can manually check and post them to the correct account code later.

4. Learn the basic principles of bookkeeping

Learn the basic principles of bookkeeping and how they apply to your business. Know the difference between your Profit and Loss account and your Balance Sheet. Understand debits and credits, and where to post different transactions. Learn how to make your accounts more meaningful so you can make informed business decisions.

Learn the basic principles of bookkeeping and how they apply to your business. Know the difference between your Profit and Loss account and your Balance Sheet. Understand debits and credits, and where to post different transactions. Learn how to make your accounts more meaningful so you can make informed business decisions.

In a time when 50% of all business fail due to a poor management control, poor planning or a lack of cashflow – YOU can radically improve your chances of success by understanding, managing and controlling your business finances effectively.

As a business owner, it is vital that you understand the basic principles of bookkeeping or accounting so that you can keep good quality and robust records yourself, or understand them if you outsource that job to a bookkeeper or an accountant.

We have our own course Bloody Brilliant Business Bookkeeping which takes you step by step through the basic principles you need to know as a business owner.

Again, there are a lot of video’s available on YouTube.

5. Learn about tax

Like it or not we all have to pay tax, so learn as much as you can about each of the taxes relevant to your business.

HMRC on YouTube – HMRC has an excellent channel on YouTube with many guides and tutorials.

You can also subscribe to HMRC webinars, email alerts and videos – self assessment, self-employment, VAT, employing people and CIS to name a few.

6. Set aside time to manage your accounts

Be disciplined, get into a routine and set time aside each day, week or month to do your books.

Reconcile cash coming in daily and cash going out weekly or monthly – get into a regular routine and set yourself reminders and To Do Lists. Write yourself a simple procedure or a list of tasks to do daily, weekly or monthly. You could use Trello to do this – we have been setting up simple repeating weekly and monthly tasks lists for some clients in Trello and this works quite well for people who like to work through a list.

[Click on the image if you want to dive in and take a closer look]

7. Keep all of your paperwork

Keep all of your business paperwork; contracts, invoices, receipts, etc. keep them in files, folders, bags, boxes, or paper wallets – it does not matter. Keep the paper until you have processed it onto your accounting software.

If you have a habit of losing paperwork, keep a small plastic wallet in your bag so you never lose a receipt again.

8. Create a system

One of the daftest muddles we see people get into – is with their paperwork! They don’t have a system so they process the same document two or three times or not at all! If two people work in the accounts team, both process the document, the cost is duplicated, one gets paid and the other looks like it is still outstanding and is at risk of being paid twice!

If you are going to process bits of paper. Buy a stamp! Implement a system for dealing with the paper.

Colop Date Stamp Printer S260 D-I-Y Text Create your own customised, self-inking date stamp with the COLOP Printer S260 set. Quick to set up and easy to change, the stamp has space for a line of text above and below the changeable date, printing the text in blue and the date in red. The set includes stamp, dual colour ink pad, one set of alpha numeric, 4mm high characters and tweezers.

Once the document has been posted to Receipt Bank / Xero or Dropbox it can be filed away or disposed of as you please.

9. Go paperless

If you are already using Xero and or Receipt Bank – then you can shred paper invoices and receipts once you have a clear copy saved to your accounts. Save value documents – i.e. invoices relating to ‘things’ you may have bought that might later need to be returned.

For all other business records, open a Dropbox (or Google Drive, OneDrive – which ever you prefer) account and save copies of key documents to your cloud file folders.

Set up a clear folder structure to file your business records.

Dropbox has a fabulous App that you can download to your smartphone or tablet so you can scan your business records quickly and efficiently. You can scan multiple page documents to PDF and upload photos of single page receipts.

10. Keep separate bank accounts

Don’t be tempted to mix business with pleasure – keep a separate business bank account and transfer money to your personal account when you need to take money out for yourself.

This will make it much easier to keep track of your business spends and reconcile your business bank account.

11. Keep money aside to pay your taxes

Open a separate deposit account for tax. If you are VAT registered open two deposit accounts.

VAT Account

- Put 1/6 of every cash receipt (i.e. £20 of each £120 received) that comes into your main bank account, into your VAT account to cover your VAT – think of VAT as cash you have collected on behalf of HMRC – it is not yours, never will be and you must be able to pay it over when it’s due. If you think of it as never belonging to you in the first place – it is easier to hand over at the end of the VAT quarter.

- Don’t be tempted to spend it – it is not yours!

- Late payment VAT penalties are huge! Avoid them if you can!

Business Tax Account

- Income Tax if you are self-employed or Corporation Tax if you are running a Limited Company.

- Once you have paid your VAT, move any surplus (saved in the relevant tax quarter) to your business tax account.

- If you are running up to date management accounts (of course you are) – save 20% of your monthly profit excluding depreciation – depreciation is added back in your tax return and capital allowances are deducted.

- If you don’t have up to date management accounts and can’t forecast your taxable profits, then try to save 15-20% of all cash receipts ) into your tax account to pay your business taxes.

- If you have any surplus cash at the year end, it can be re-invested in the business or taken as drawings or dividends out of profits.

It’s a tough but worthy discipline to get into the habit of saving for tax as you go.

Bootstrap, budget and borrow (if your business can sustain the loan repayments and interest charges) but don’t spend your tax money. HMRC do not look kindly on you using ‘their’ money to pay your business or personal expenses and can wind your business up (or go after you personally) if you are not able to meet your liabilities.

12 – Review regularly

You are the worker, the manager, the investor, the director and the chief financial officer of your own business.

Take time out each month to review your accounts and see that you are on target (you have a plan right?) and making sustainable profitable growth in your business.

If you are making losses – what income can you grow and what costs can you cut to draw the salary you need to survive and turn your business to profit? What costs are out of control? Which revenues are falling? What is your Plan B?

If you are making profits – how do you make more? Do you need to make more? How can you improve on what you are doing? Is it time to invest or seek investment, bring in new products and services? Have you achieved your objectives? What do you want to achieve for next month? Can the business run without you?

And finally – find a good Accountant!

Find an accountant who understands your business, who knows what you want to achieve and can help you reach your goals. Good accountants do not come cheap but should help you make money, save money or pay less tax.

Sign up to their newsletters (sign up to several – they will all have a different flavour), join their Facebook groups and start engaging with them. You can get a lot of free advice in these forums.

Most accountants will give stuff away for free, others won’t charge for an initial consult. Most will also allow you to pay for an hour or two of consultancy if you get stuck without asking you to commit to an ongoing fee.