You can trade without making a profit, but you can only run out of cash once.

- Cash is the lifeblood of the business, so it must be treated as such

- Effective credit control can be achieved by implementing procedures to ensure regular review and persistent chasers.

- Implement regular robust controls now to avoid the pain of late payers and the risk of writing off bad debts later.

- Effective credit control is simply – consistent, persistent and polite payment reminders issued to your clients.

- It doesn’t matter if they are verbal, written, or automated – or a combination of these so long as you actually have a credit control process in place.

The ‘do nothing’ approach

We often see business take the ‘do nothing’ approach.

- Rather than actively Rather than actively chase the clients for payment of invoices, they leave it to their client to decide when to pay.

- It doesn’t matter whether they are doing nothing because they simply haven’t got round to credit control, if it’s because credit control makes them feel awkward or uncomfortable or if it’s a conscious decision not to do credit control.

- The result is the same, they don’t get paid – or certainly they don’t get paid as quickly as they would like.

- Clearly that’s not the right approach to take so what should be do?

Write a policy and procedure document – and use it!

Write a formal company policy and implement a procedure for your credit control to establish robust, repeatable working practices.

- Issue written procedures and make sure staff understand them to ensure everyone involved in credit control follows the same process.

- Credit control policies formally documented help create a culture of discipline and control for the future.

- Establish good habits early on in your business and embed them in your culture.

- Even a one man band can have a credit control policy, referring to company credit control policy when chasing unpaid bills makes the company look and feel bigger than it really is.

- Click on the link to the left to download and customise our credit control policy for your business.

Review regularly

At least once a month you should hold a credit control meeting.

- If you are a one man band – book a time in your diary for the regular review of your Aged Debtors – the people who owe you money

- If you have bookkeeping staff or a hands-on accountant – then include them in your review

- Monday morning is a great time to review your Aged Debtors – see who has paid over the weekend and start the week with a friendly reminder of the outstanding invoice. This keeps you front of your customers mind early in the week.

- If you are a bookkeeper or director with staff – set a regular meeting in your diaries to review credit control.

- Review your aged debtors list;

- chase aged debtors,

- decide what to do with persistent late payers review credit limits when necessary and pout overdue accounts on ‘STOP’

- take action on the non payers – a red doormat letter or initiate legal action

- Remember somebody 60 days overdue this month, could be 90 days overdue next month.

Issue Regular Statements

Automate your credit control process.

- Issue regular statements electronically with escalating covering emails.

- Save time and collect cash faster by automating the process to collect the slightly overdues and those who had not got round to paying you yet. save your time and energy for the difficult late payers.

- Chase weekly! Gone are the days when we chased at the end of each calendar month for invoices 30, 60 and 90 days overdue.

- Your emails will normally start with a friendly and gentle reminding nature but will escalate in tone and wording over 7, 14 and 21 and 28 days.

- Generally you start off with a friendly reminder, you get more firm as time goes on insisting that the client brings their overdue account up to date or at least contacts you to explain why payment is delayed before you finally threaten to take legal action.

- If you are going to send a paper statement buy a rubber stamp and physically stamp the statement as being overdue.The process is simple but can be quite effective when it arrives on the desk of an Accounts Payable clerk. No one likes to see a payment OVERDUE statement on the desk as they know what’s coming next!

- If you use Xero, you can turn on the automated invoice chasers and set up regular reminders. If you have clients or invoices that you would like to chase you can turn off invoice chasers at client and invoice level. Xero will send a reminder for each invoice, so if a customer has 5 outstanding invoices, they will get a chaser for each one.

- Use Chaser for a more sophisticated approach. Chaser allows you to set up multiple chaser streams, so if you have different brands with different terms then you can set up a chaser stream for each brand. As with Xero, if you have clients or invoices that you would like to chase you can turn off invoice chasers at client and invoice level.

Stand Out on The Doormat

Stand out from the crowded doormat.

- With all the post we get through a lot of boxes it’s hard to stand out on the doormat.

- If you are going to post a late statement you could print it on red paper so it stands out in a desk tray or you could post it in a red envelope.

- Handwrite the envelope and address it to the head of finance or the director and you will be sure to get their attention.

Pick up the phone

No one likes to make telephone calls chasing money.

- It’s awkward and uncomfortable but in today’s economic climate it really has to be done.

- Plan your calls and prepare your script ahead of time to ensure that your tone is professional and calm but authoritative.

- You are not going to crumble, you are going to be polite and firm and address the overdue account with confidence.

- If you sound like you mean business, your client will be more inclined to make payment.

- We have prepared a number of telephone scripts to help you. Click on the link on the left, you can take our scripts and edit them to suit your business.

- Ensure that your calls are professional and effective allowing you to build on the relationship you already have with your customer.

- Practice your script, role play if you have to.

- Prioritise and call your higher value debtors first.

- Don’t apologise for calling or chasing – it’s not your fault they have not paid.

- Don’t get cross, it won’t hep your cause if you get frustrated with your customer.

- Don’t sound desperate. You don’t want to imply that you are imminently insolvent if you don’t get paid immediately if you want to continue working with your client.

- Be patient and understanding. It may be embarrassing for your customer to admit that they are experiencing cash flow problems themselves, but if they feel comfortable enough to be honest with you then you stand a better chance of getting those invoices paid quickly. If your fortunes changed and you found yourself in their shoes, how would you like to be treated?

- Keep detailed records. Record notes of conversations and promises to pay in your accounting software so that you and anyone else who speaks to the customer knows what is going on.

Pre-empt the excuses!

Be prepared!

- Know what you’re going to say when your client starts to make excuses for non-payment .

- Simply accepting that that is the case is not very helpful for your cash flow and will probably move you to the bottom of their creditors list if they think you are a bit of a soft touch.

Understand why people don’t pay!

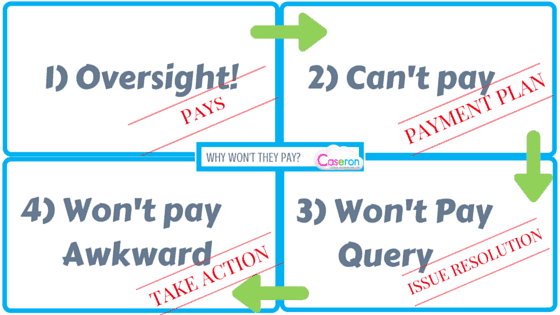

There are generally four reasons why people won’t pay:

- Oversight – either they forgot or they are their behind in their paperwork. They haven’t deliberately missed your payment and when you chase, they will often pay you straight away – usually with a humble apology for the delay.

- They can’t pay. They’re short of funds and are unable to pay. In this case don’t offer any more services, put them on hold and agree a payment plan until your account is settled in full all comes down to an acceptable level within their Credit limit

- They won’t pay because there was an issue or a query with the service or product you sold. Talk to customer – you need to understand what their issue is and how you can resolve it quickly and efficiently, So you can be paid.

- They won’t pay because they are awkward. Sometimes people are just difficult and there isn’t any reason for non-payment which often means you chase and chase and chase and they pay reluctantly the day you are about to launch legal proceedings. If you have any clients like this then stop providing credit and asked them to pay for future orders upfront.

New customer engagement

When you take on a new customer do your due diligence.

- Your due diligence will of course very much depend on the type of product you sell and the risk of not been paid.

- Cash businesses don’t need to offer credit and have less risk of the customer not paying.

- A business offering 30 days credit on thousands of pounds of computer hardware has an entirely different risk profile and should credit check clients before offering credit.

- If your customer wants to buy on credit then you should be running credit checks on them to establish an appropriate credit limit.

- Online services such as CreditSafe.co.uk, Experian.com, or DueDil.com can provide company credit checks and suggest credit limits.

- You can use our New Customer Details Template to collect the details you need to set up a credit account.

Define your terms and conditions

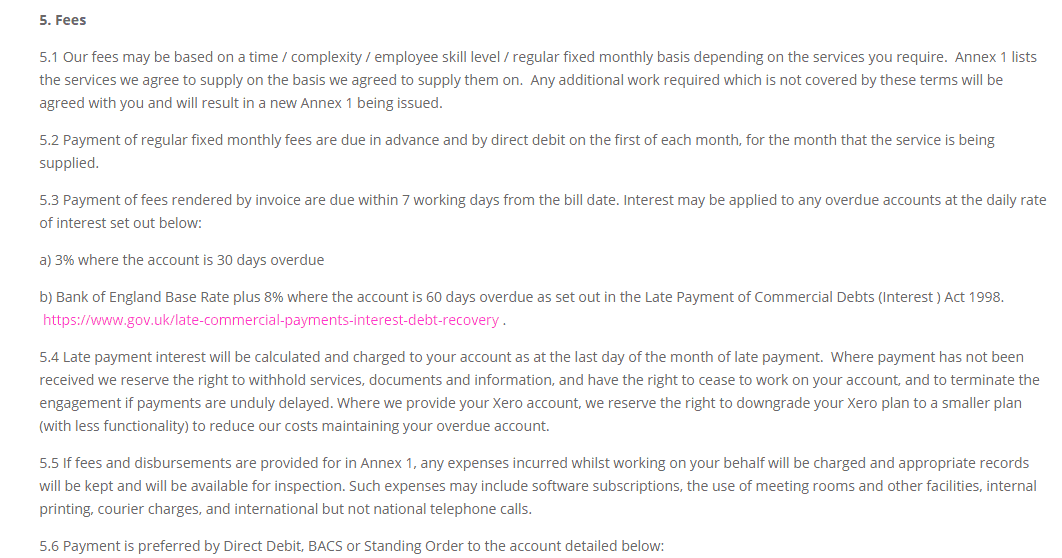

Make your terms of payment part of your terms of business

- Write your credit control policy into your terms and conditions to ensure that your customers are aware of your terms of trading before they engage with you in business.

- It makes it easier to chase and reinforce payment terms if your customer is fully aware and signed up to them.

- Implement late payment changes and actually charge them.

- Charge for bounced cheques and direct debits – they will cost you admin time to process

- Ensure Terms of Trade include a Retention of Title Clause which means that you retain title to the goods until they are paid in full.You should have this drafted by a solicitor familiar with your business to ensure you are fully protected.

- Your Terms and Conditions should allow you to charge interest on late payment and a complaints procedure for dealing with disputes.

Give your customer every opportunity to pay

Make it easy for your customer to pay.

- Setting up as many payment gateways as possible and practical for your business.

- Make sure you quote your bank details on all invoices, statements and chaser letters – don’t make your customer go hunting for them. Even though your customer may have your bank account details set up in their online banking, some still like to check that your bank details haven’t changed before arranging payment.

- If you have changed your bank details recently – make sure your customers are aware. There will be one or two that don’t look, and pay into your old bank account.

- Set up alternative payment gateways such as Stripe for credit cards and paypal. Whilst they may cost a little more in transaction fees, they may actually work out more cost effectively in the long term as you may be able to get payment faster which saves you the admin time chasing the invoice.

- Some customers may prefer to pay on card and take advantage of extended credit terms – perhaps their customers pay on 30 days while you are expecting payment on 7. The advance of technology, everything being in the cloud and online payment services – means even the smallest businesses can now take payment by Direct Debit or Credit card without having to set up Merchant Accounts and expensive fixed costs Credit Card terminals.

- If you use Xero, each of these systems integrates with your business accounting software saving time on reconciliation and bookkeeping.

- Consider:

- Direct Debit with Directli

- Credit card with Stripe

- Paypal

We use each of these and can help you set these payment gateways up if you would like to implement them in your business.

Use your salesforce

Make best use of mobile staff.

- If you have a mobile salesforce and feet on the ground that regularly go into your clients offices then use them to facilitate credit control.

- They could talk to the accounts department, they can hand deliver statements or red chaser letters and they can put customer orders on hold until payment has cleared.

Get perspective

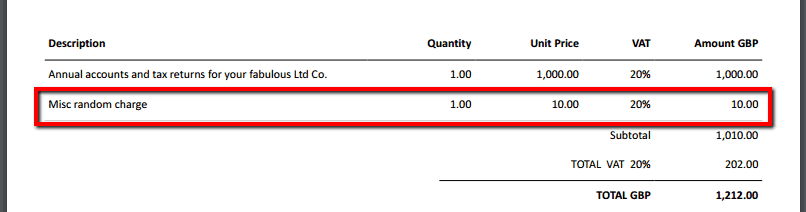

Take a look at your outstanding invoices. What’s the hold up?

- Could it be that £1000 invoice is not been paid because of a £10 query on one particular line item?

- If this is the case raise a credit note for the queried item so that the invoice contains only undisputed items, and re-invoice the disputed items separately so it can be paid once the query is resolved.

Own it and just do it

Cash is the lifeblood of your business so be in control, be effective and try and find ways to help you customer pay you.