Debits and credits can sometimes seem confusing but you will need a basic understanding of how debit and credit transactions affect your accounts to be able to understand your business reports and spot any anomalies.

The concept of double entry accounting dates back to 1494 when the first principles of double-entry were developed by an Italian Monk named Luca Pacioli – the basic concepts have changed very little since.

The term double entry accounting comes from the basic principle that every business transaction has two entries. A debit and a credit.

- There will always be (at least) two entries for each transaction

- There will always be a debit and a credit in each transaction

- The debit and the credit must be equal, they must balance.

Essentially these represent the giving and receiving of a benefit.

Debits and Credits are like belly buttons!

Innies and outies!

Not a particularly grown up way to think about it, but this how I learned and have never forgotten!

DEBITS are innies and CREDITS outies.

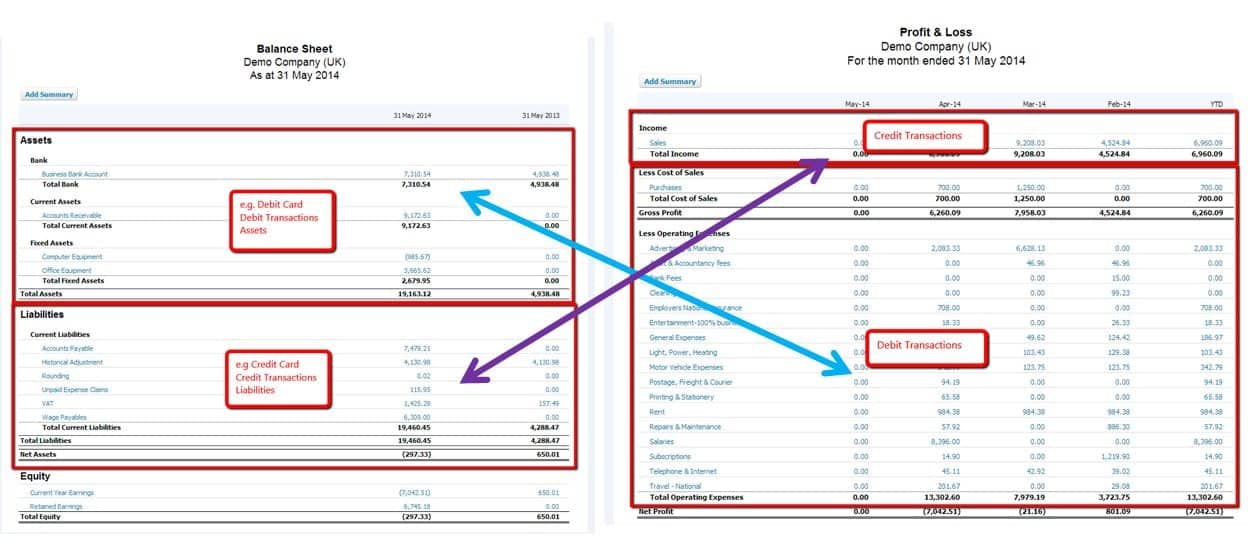

Debits and credits in the Balance Sheet

Firstly, you probably know a lot more about debits and credits than you might think, consider your own DEBIT and CREDIT Cards.

- DEBIT Card – This is money you physically own, this is your asset. Any spend you make from your DEBIT card will immediately reduce your asset – your bank balance. Therefore your assets in your balance sheet will be made up of DEBIT transactions.

- CREDIT Card – This is money you owe, as you will need to pay this back this is your liability. The liabilities in your balance sheet will be made up of CREDIT transactions.

DEBITs and CREDITS are exact opposites, in the same way as “Plus +” and “Minus –“.

They also work like Yin and Yang, you cannot have one without the other and whenever you create a DEBIT transactions there will also need to be an identical CREDIT entry to match it.

| Balance Sheet structure | ||

| Transaction | Debit | Credit |

| Assets | X | |

| Less liabilities | X | |

| Equals capital or equity | X | X |

Your business balance sheet may look like this:

Remember, in balance sheet terms – the sum of your assets less your liabilities equals your capital or your equity.

Debits and credits in the Profit and Loss (P&L)

Generally, income will always be a CREDIT and expenses will always be a DEBIT – unless you are issuing or receiving a credit note to reduce income or expenses.

| Profit and Loss or Income Statement structure | ||

| Transaction | Debit | Credit |

| Income | X | |

| Less expenses | X | |

| Equals profit or loss | X | X |

Your business P&L may look like this:

Let’s look at some examples of typical business transactions and how they might impact your accounts.

Example 1

Say you use your DEBIT card to pay for some stationery. From a balance sheet perspective – you are moving funds from one location to another – e.g. from your bank account to someone else’s bank account, from a P&L perspective you are incurring a cost.

| Purchase £15 of stationery from Bills Paper-me-bobs in Cash | ||

| Transaction | Debit | Credit |

| CREDIT the Bank to reduce your bank balance in the balance sheet |

15 |

|

| DEBIT the Stationery expense code in the P&L with the cost | 15 | |

| Total | 15 | 15 |

Example 2

Say you use your CREDIT card to pay for some stationery. From a balance sheet perspective – you are creating a liability. You have incurred a cost on credit that you will pay for later. From a P&L perspective, you are incurring the same cost as you did when you paid for the item in cash.

| Purchase £15 of stationery from Bills Paper-me-bobs on a credit card | ||

| Transaction | Debit | Credit |

| CREDIT the CREDIT CARD liability account; increase your liabilities the balance sheet |

15 |

|

| DEBIT the Stationery expense code in the P&L with the cost | 15 | |

| Total | 15 | 15 |

Each DEBIT must have an equal and opposite CREDIT

Example 3

When you make a sale, for cash or on credit, you would create the following entries.

| Make a cash sale or credit sale of £50 to Wendy Plumber. | ||

| Transaction | Debit | Credit |

| You will increase your cash assets by £50, so DEBIT Bank with the £50 received

IF You raise an invoice for £50 and give Wendy 30 days credit, the DEBIT entry goes to Trade Debtors or Receivables. This is an asset in your balance sheet until Wendy pays you the balance owed. |

50 | |

| CREDIT Sales in your P&L | 50 | |

| Total | 50 | 50 |

Bank Statements – the confusion they cause

Now you may be wondering why your bank statements say the exact opposite to what your accounts say when it comes to DEBIT and CREDIT transactions, in fact, all transactions will be the opposite from the information the bank gives to you.

This is because the bank statements you receive are from their point of view – not yours. Whoever knew a bank would be self-centered?

The reason this is the opposite to yours is that if you have a DEBIT card bank account with them this is money they owe to you whereas a CREDIT card will be money you owe them. Your asset is their liability, equal and opposite.

However, these are your accounts and you want to portray them from your point of view.

So how does this work in practice?

The profit and loss account and the balance sheet work in harmony in double entry accounting. A DEBIT in one will be a CREDIT in another.

In fact, you may even notice if you put both financial reports side by side, they are complete opposites.

Why might I need to know this?

Generally most systems do these majority of these entries automatically for you; however, you want to be able to understand if something doesn’t quite look right and what could be causing it to look different.

This is also so that you can understand any journals, transactions, invoices, credit notes or adjustments in your accounts. Which can be especially useful if you have more than 1 person creating entries. That way you can look for anything which looks abnormal more but more importantly, it means you can understand how to go about fixing it.

This is the basic concept for how accountants and bookkeepers make adjusting journals – allowing them to accrue and prepay costs across your accounts so that your income matches your expenses.

If you understand the basics of DEBITS and CREDITS you understand much more about accounting than you might have originally thought.