- you have to have a self-bill agreement in place with your supplier, see The Ins and Outs of Self-Billing

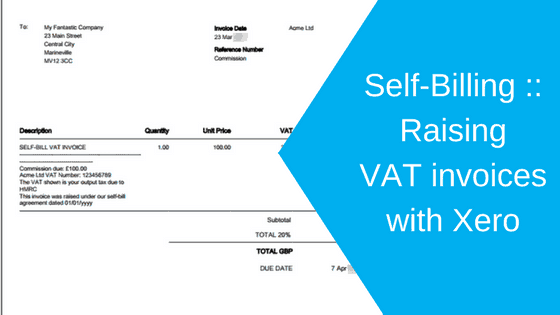

- you have to raise a self-bill invoice which includes;

- the supplier VAT number

- A document title to show this is a Self Bill Invoice

- A reference to the self-bill agreement

- The invoice must also note “The VAT shown is your output tax due to HMRC”.

See also:

Producing a VAT Self Bill invoice – outside of Xero

Xero does not currently have functionality to generate a VAT supplier invoice on a self-billing basis.The quickest and easiest way to create one, is to use a Word or Excel invoice template. Better still if this template is provided by your supplier at the time you entered into the self-bill agreement.

The self-bill invoice can be entered into Xero in the same way as you would post an ordinary purchase invoice.

Send a copy to your supplier, so they can enter it into their own accounting system.

Producing a VAT Self Bill invoice – in Xero

Having said that Xero is not able to produce a proper self-bill VAT invoice, we can use Xero to create a document that ticks all the boxes required by HMRC. So long as you are not overly fussing about presentation.

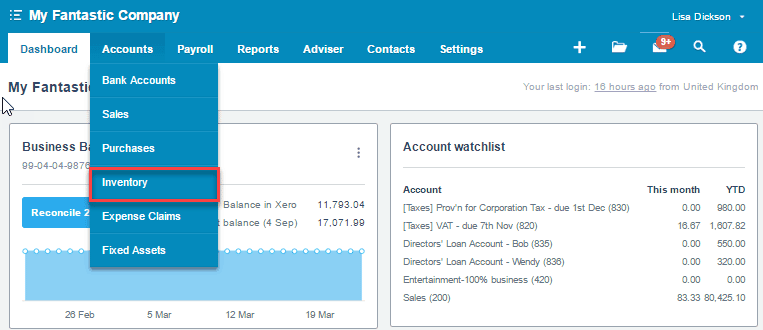

To save time creating your invoice narrative – you can set up an untracked inventory item for each self-billed supplier so that you can quickly generate a new self-billed invoice quickly. When the item is untracked, no stock is recorded making this a useful feature for creating standard sales or purchase line entries on invoices.

1) Go to Accounts >> Inventory to add a new self-bill inventory item in Xero

2) Enter the following text into the Purchase Description field. The text should be as simple or as detailed as is appropriate for your transaction. If your supplier is a Limited company, you may also want to include their company name and registered office address in your narrative.

| SELF-BILL VAT INVOICE —————————————————————————————————–

|

3) Save the new item.

4) Complete and approve your purchase invoice creating a new line for each amount payable and approve it. In this case we have used commission but you may be self-billing for a different service.

5) Print the PDF invoice. You will note that this document prints with a comment ‘This is not a tax invoice’ at the bottom of the page – this needs to be cropped out of the document before it can be sent to your supplier. Save a copy of the cropped document to PDF, attach it to your transaction in Xero and send a copy to your supplier.

This format is not perfect but does include all the information required by HMRC for self-billing arrangements with VAT registered suppliers.

Book A VAT Review

£120.00