If you are running payroll for your accounts. Whether it is for Director’s or for Staff you should be entering in the relevant costs and liabilities into the accounts.

We create a payroll journal so we can see the relevant cost of the payroll in the Profit and Loss while also showing any payments owing to HMRC or any under/over payments for staff.

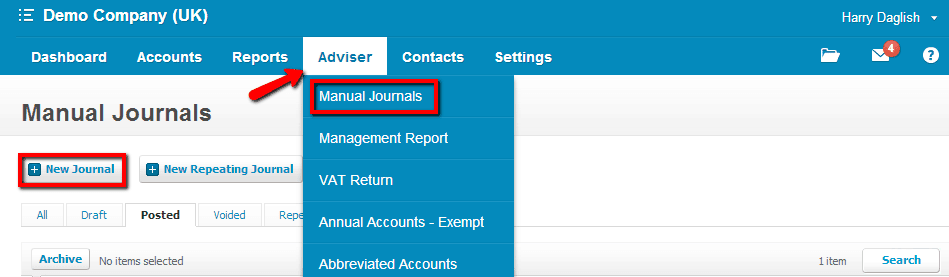

1) We can create a manual journal through the adviser tab in Xero. Whether you use Xero or another system the same principle for creating journals will still apply.

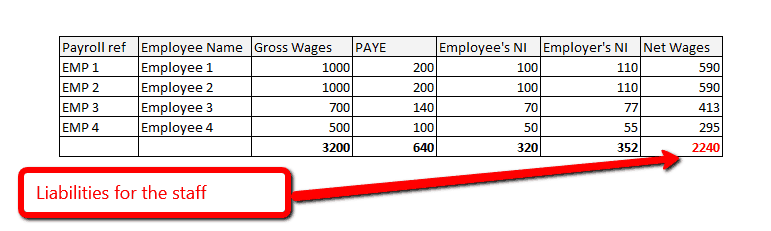

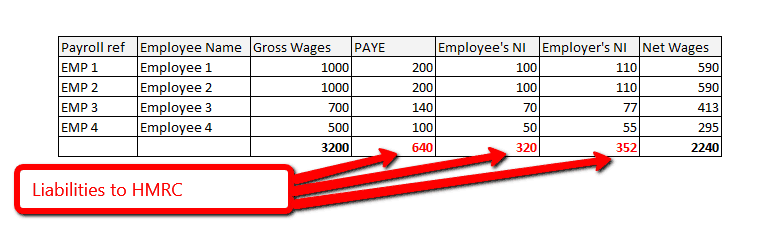

2) Start by viewing your payroll information. We need to identify the relevant costs and liabilities

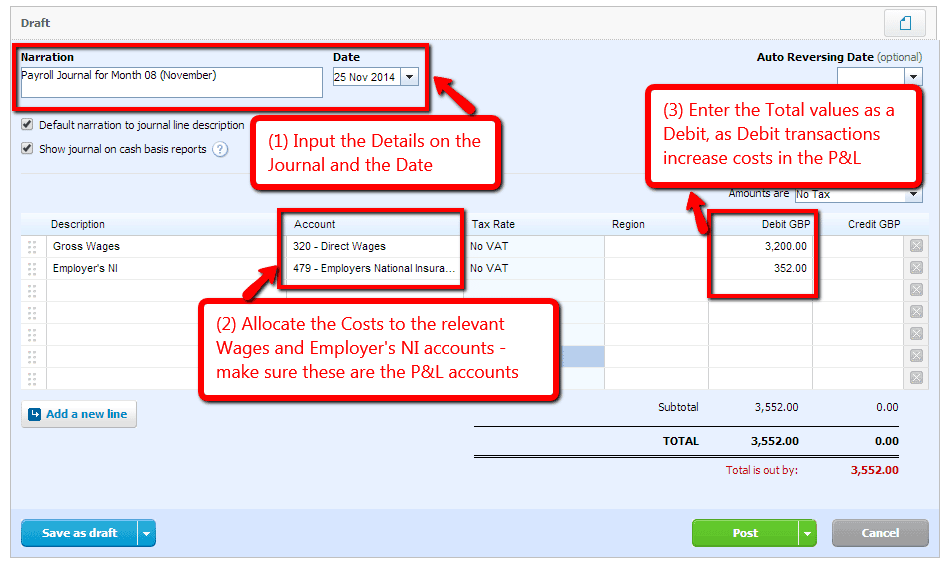

3) The costs which are relevant to the payroll are the Gross Earnings and the Employer’s National Insurance Contributions. We can refer to the total value of these columns for our payroll.

4) We’ll start building our payroll from scratch for this exercise. It is useful to enter which payroll period the journal relates to in the narration. As we are starting with the Cost elements we will need to make sure these affect our Profit and Loss Account Codes.

*There will be some reference to Debits and Credits, if you would like some further understanding of these please refer to our Debit and Credit article

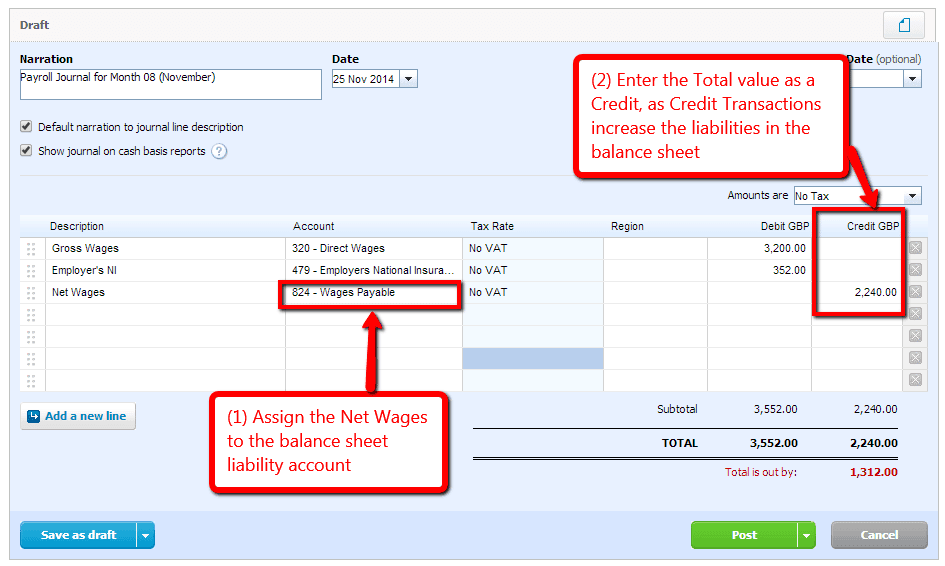

5) The next step to look at the liabilities in relation to the payroll. Until the staff are paid we will need to show how much we owe to them. The amount to be paid by the staff is the Net Pay.

6) We can now add this to our payroll journal, the Account Code which this affects must be a Balance Sheet account.

7) The final item we will need to show are the liabilities owing to HMRC. These liabilities are made up of PAYE, Employee’s National Insurance and Employer’s National Insurance

8) We can enter these in the journal as shown below. You may notice that Employer’s National Insurance appears twice – this is not deducted from an employee’s Gross Wages so is an additional cost which relates to running the payroll. But it is still also owed to HMRC.

If you have a Director on the payroll

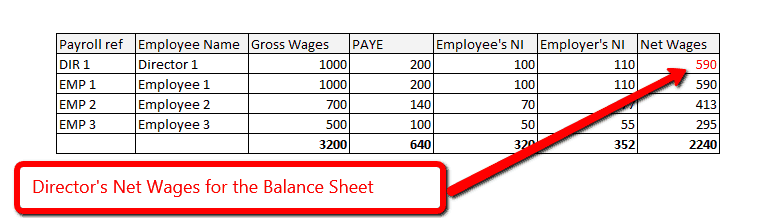

If you have a Director on the payroll you will need to isolate their Director’s salary from the other staff members. You may also have a Director who does not pay themselves the exact net pay but instead draws down a balance intermittently.

We can instead allocate their Pay elements differently to isolate them on the payroll while also creating a balance they can draw against.

1) The first cost we will need to isolate are the Gross Wages of the Director

2) The second item we will need to isolate is the Director’s Net Pay. The PAYE and NIC elements will not need to be reallocated in the journal.

3) You can create the journal in exactly the same way as before, the only difference is that you can move the Director’s Gross pay and Net pay in to separate account codes.

When any payments are made to staff they can be posted to the Net Wages Payable account. This will reduce the liability in the balance sheet.

When any payments are made to directors they can be posted to the Director’s Loan Account to offset any drawings.

When any payments are made to HMRC in regards to PAYE and NIC’s they can be posted to the relevant Payroll liability accounts. This will reduce the liability in the balance sheet.