So you are really busy, constantly travelling or you just have so much to do – you don’t have time to sort your expenses? It’s one of those ‘Eat That Frog’ kind of tasks – stop putting it off and just get it done! File your expenses regularly and keep on top of the paperwork to avoid an admin nightmare later. Here are some useful expenses hacks for making things simpler for yourself!

Taxis

Use Uber. All receipts are charged to your personal account so your accountant or bookkeeper will always know where to find them.

Keep receipts

|

- Make sure you keep all receipts – you will need a proper VAT receipt to reclaim the VAT if you are VAT registered.

- Keep VAT receipts and credit card slips – if you pay with multiple accounts, cards, in currency, your own bank account, cash – it will be easier to trace back to the original source .

|

Keep safe in a document wallet

|

Either file business receipts in a separate pouch in your purse/wallet or buy a plastic wallet (A6 size is perfect) and keep it in your bag/rucksack or case. Keep a small half pencil in the wallet for making notes if you need to. |

|

Automate – snap and send to Receipt Bank

|

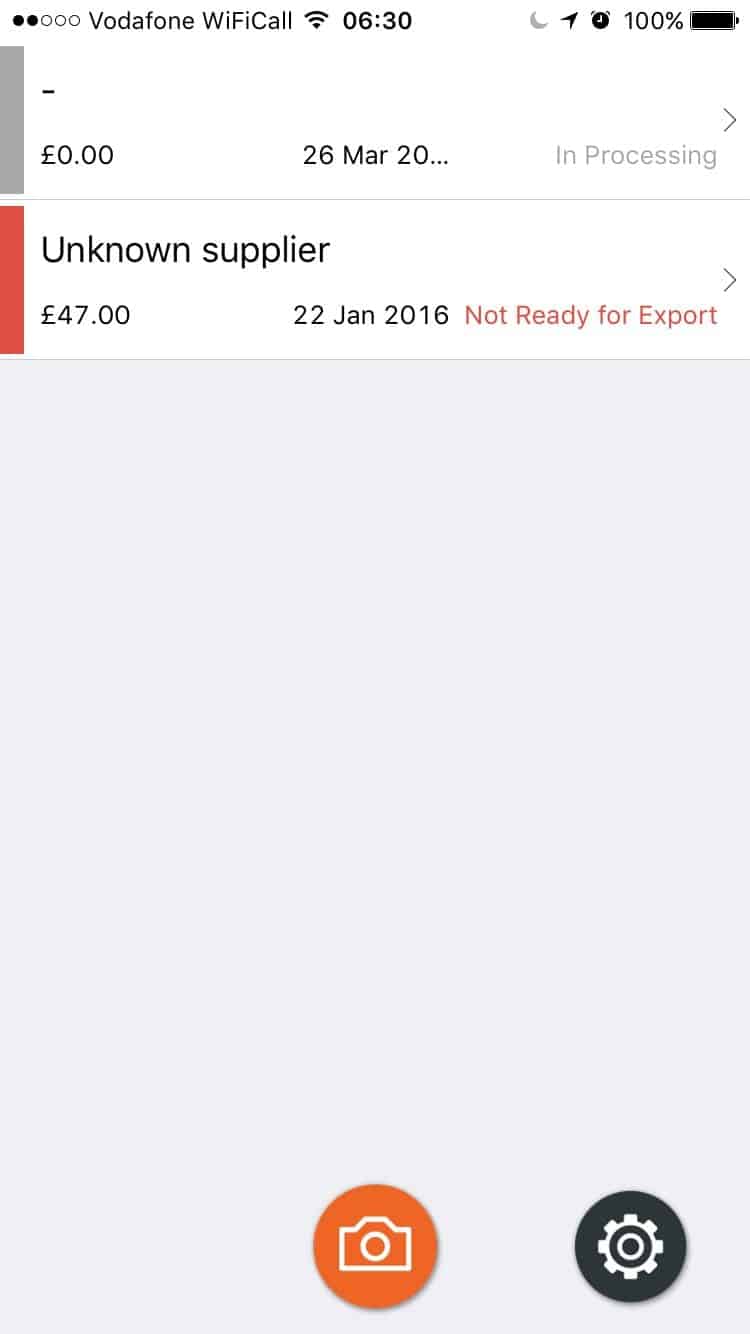

- Use Receipt Bank and snap those business expenses into the App next time you sit down.

- <<< Click on the edit button to add notes and a description

- If the receipt is ‘In Processing’, leave it alone to be processed. If the receipt is marked ‘Not ready For Export’ click and review. The receipts has missing information and can’t be processed until you correct it. >>>

|

|

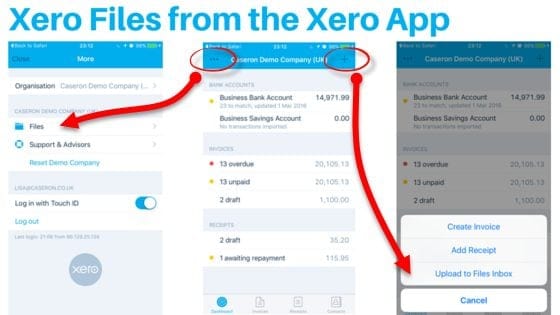

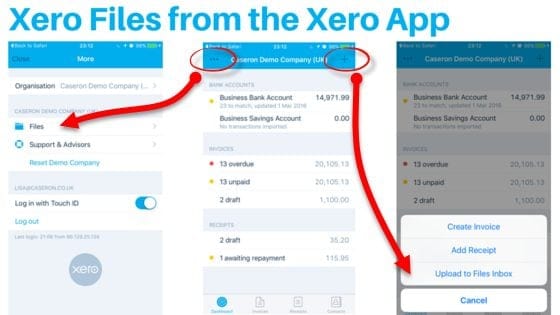

Automate – snap and send to Xero files

Or, download the Xero App, and snap away. There are two ways of accessing Xero files from the App.

Keep or Bin the paper receipts?

|

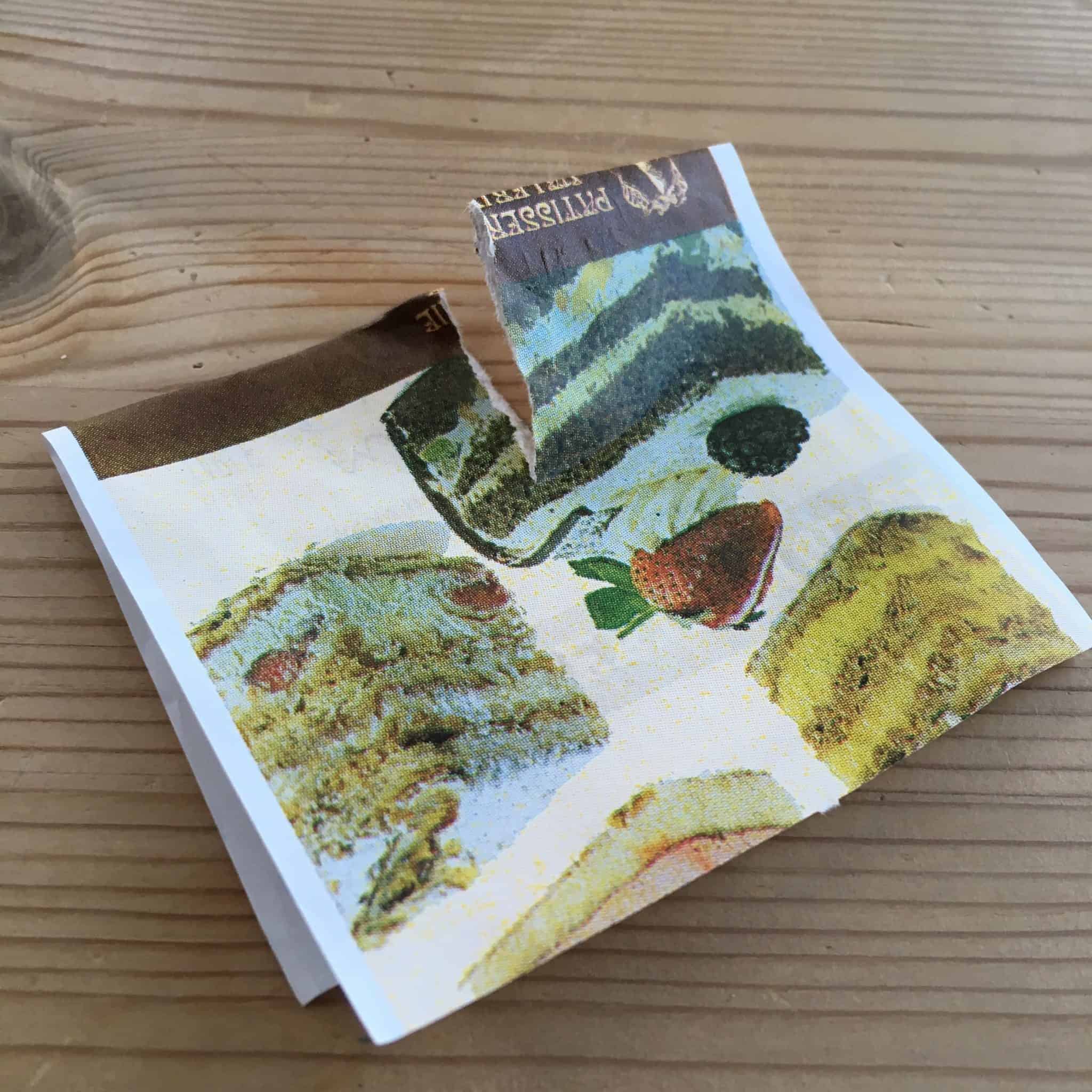

- If you carry a pen or pencil with you – then mark the receipt as ‘sent’ to Receipt Bank/Xero.

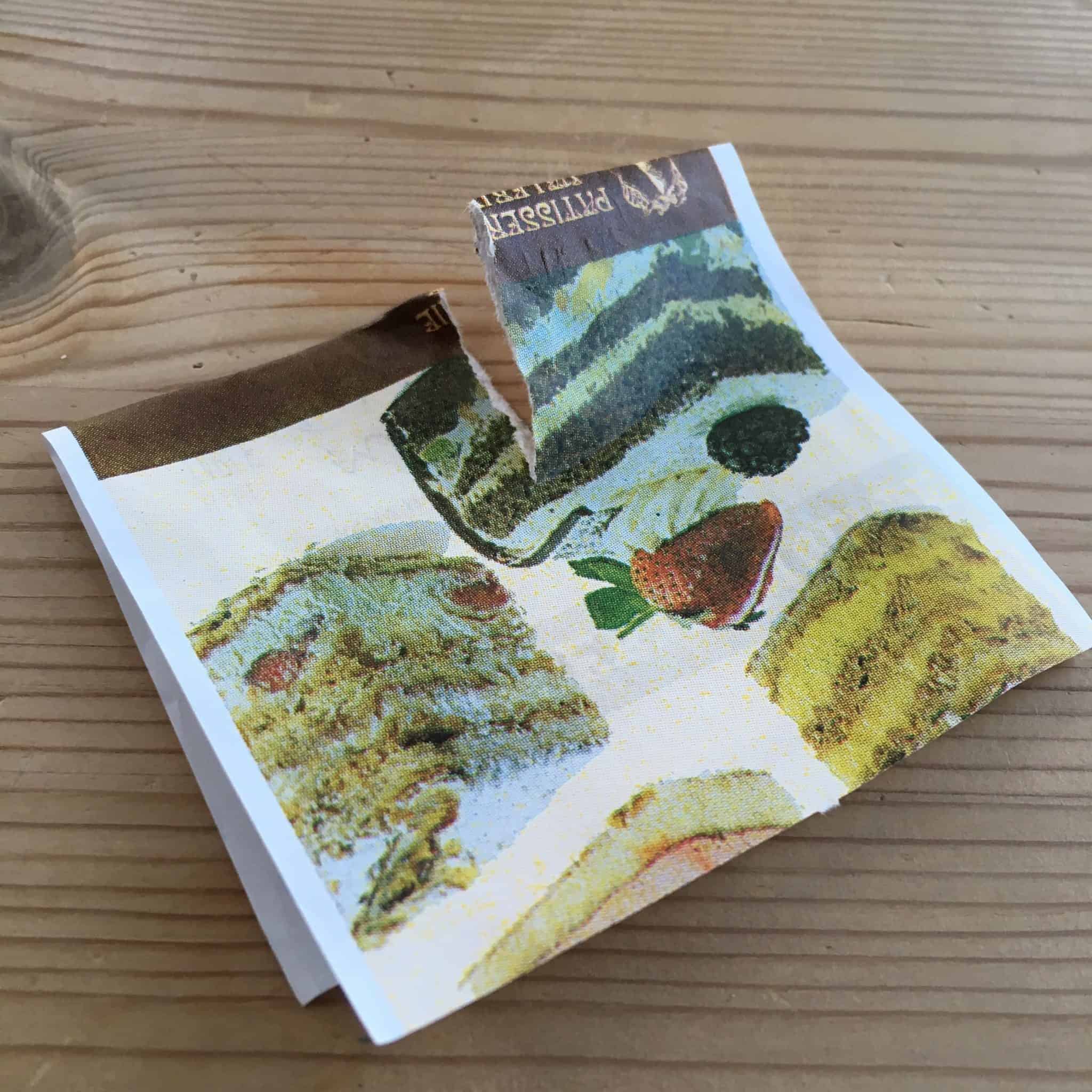

- Don’t have a pen? No problem, fold the receipt in half and tear it so you know that one has been snapped.

- Bin them? Normally it’s ok to throw these receipts away once processed

- Keep them? You may prefer to keep them until you are certain they’ve been processed – marking them helps you know which receipts you have processed, and which haven’t.

- Always keep – any that relate to a product you might later wish to return.

|

Eat the frog! Keep your accountant happy, and avoid the potential admin headache – keep on top of your expenses!