Accounting for CIS

So we understand the principles of CIS, but how do we account for the transactions in our accounting software?

See An introduction to CIS if you need to recap.

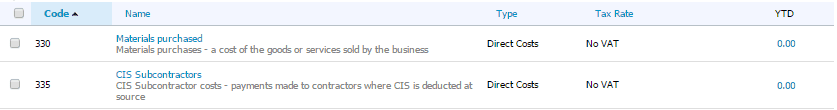

Account Codes

We recommend that you set up the following general ledger account codes in your accounting software (we will use Xero to show you how we manage CIS transactions with our clients) :

Profit and Loss Account:

We will need direct cost accounts to account for the labour and materials costs.

- CIS Subcontract labour

- Materials.

- If you post your material purchases to stock, this would be a balance sheet item. For the purpose of this article, we will assume materials bought from subcontractors go straight to the profit and loss account and that our subcontractors are not VAT registered.

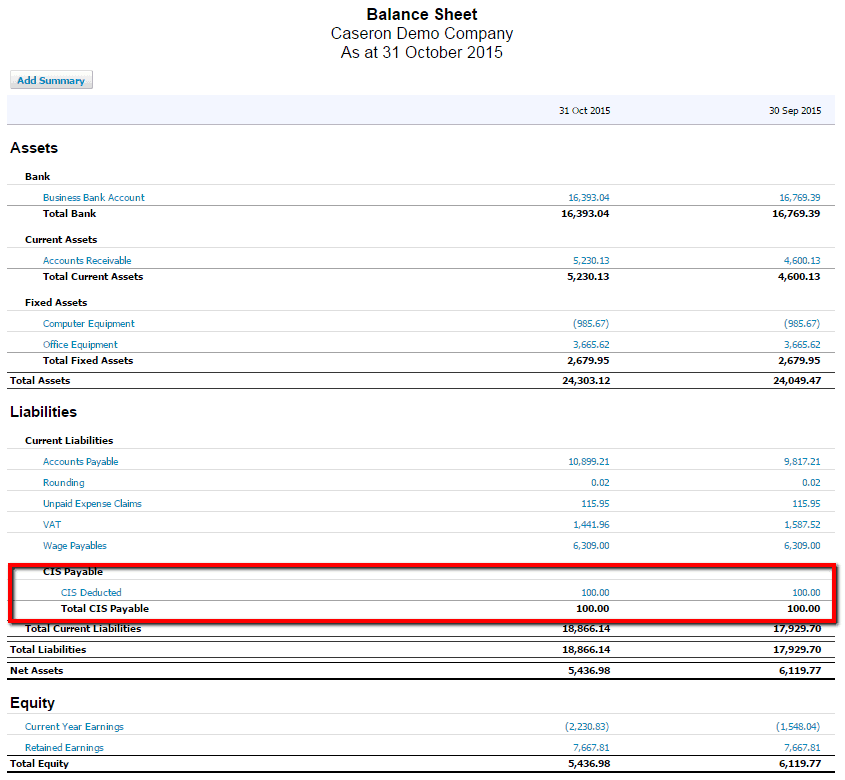

Balance sheet:

As you have to report each of these CIS elements separately to HMRC, we recommend you capture them separately in your accounts but group them in your balance sheet. You can see at a glance what your liabilities are each month and report on the transactions within each account to get the details for your HMRC reporting.

- CIS Deducted

- CIS Suffered

- CIS Paid

Using payroll software for CIS returns

You can process CIS payments in a payroll system, but we like to keep the detail in Xero as it:

- keeps all the information in one place – useful for reconciliation, HMRC checks and review with your accountant

- retains the whole ‘life cycle’ of your CIS reporting in your business accounts so we can reconcile costs posted to your profit and loss account, drill down on liabilities and report on the data required for HMRC CIS reporting

- By treating each subcontractor as a supplier, you will create a full transaction history of costs incurred, payments made and balances still owed to the subcontractor.

If you have a large number of CIS contractors you may want to use a payroll system such as myPAYE for producing the monthly returns. You’ll still need to account for the costs, payments and liabilities in your business accounts, so we will look at that now in more detail.

Posting a subcontractor invoice to your accounts

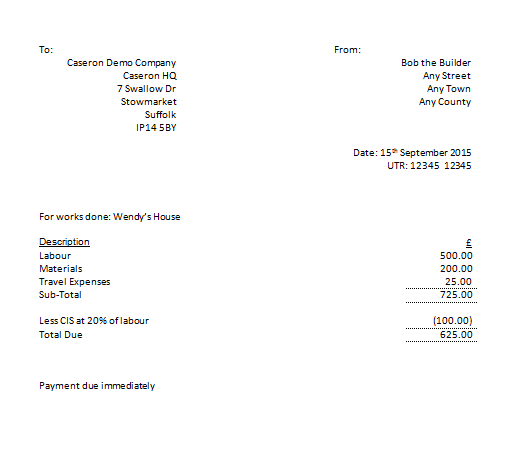

We have received the invoice below from Bob the Builder, we need to post this into our accounts and pay Bob the £625 due as soon as possible.

Even if we do not get actual invoices from our subcontractors, we will create dummy invoices to account for the payments – you will see why later.

We enter the invoice into our accounting system as follows. For the purpose of this demo we are assuming that we are paying our contractors as soon as we have entered the bill, or at least within the same CIS accounting period (06-Mth-Yr to 05-Mth-Yr) so that our costs and payments appear in the correct month for CIS reporting:

If we only had one CIS contractor invoice in our accounts, our balance sheet would show that we had a £100 liability to HMRC for CIS tax deducted but not yet paid.

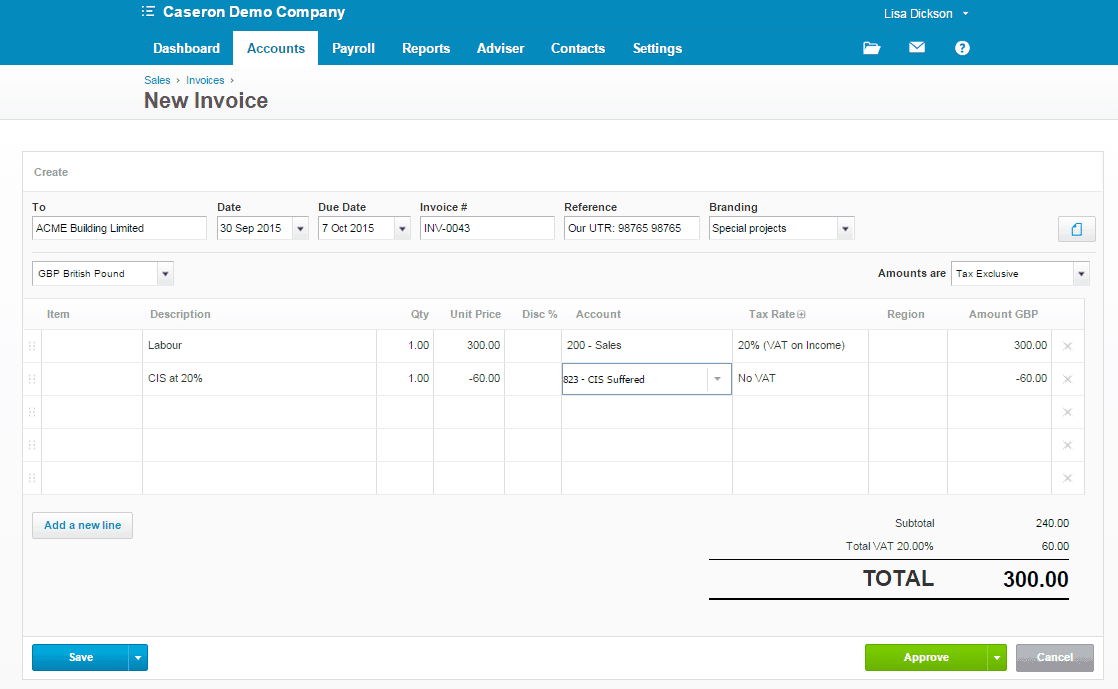

Creating a sales invoice accounting for CIS Suffered

Say we do a job as a subcontractor for ACME Building Limited. We will need to raise a sales invoice recording the CIS suffered. We are VAT registered so we will raise an invoice for the work we have done plus VAT, less the CIS suffered – which has no VAT on it.

Now when we go back to our Balance Sheet we will see that we have deducted CIS of £100 and suffered CIS of £60 and we owe HMRC CIS of £40.00.

If we paid the CIS to HMRC the following month, the balance sheet would look like this.

- Sept – the liability for CIS was created in September so at the month end we owed HMRC £40.00

- Oct – the debt to HMRC was paid in October but we have incurred no additional costs so the carried forward liability is £0

You can, of course, account for CIS paid, suffered and deducted in a single CIS deductions account but we find this is simpler for CIS reporting. It keeps the accounting tidy if you have credit notes to account for – say for example you or your subcontractor raises a credit note that reduces the amount of CIS deducted or suffered – the adjustment is reflected in the correct account.

Reporting CIS deductions with HMRC CIS online

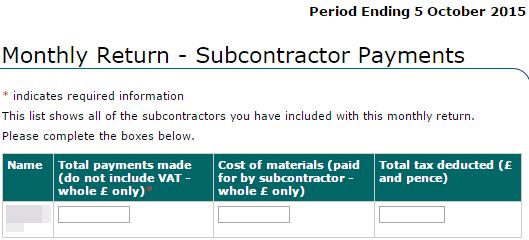

You need to report the CIS deducted on payments made to contractors in your monthly returns.

You will report deductions on payments made within the period, in this case, 06-Sep to 05-Oct.

You can find the information on the deductions by reporting on the CIS Deducted Account and you can drill down on each transaction by contractor to find the total payment paid, materials value and CIS deducted from the payment.

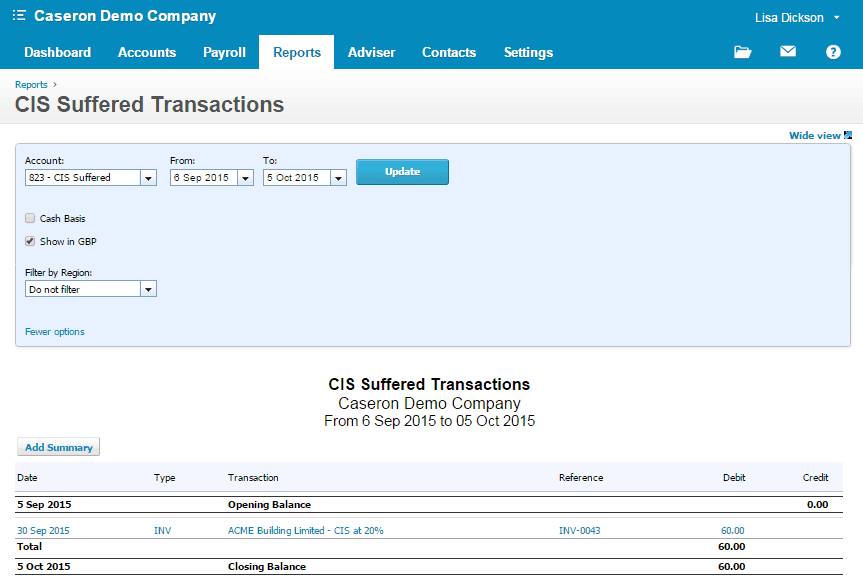

Reporting CIS suffered on sales

CIS suffered is reported within your payroll EPS.

Be careful – this is reported Year To Date in some systems (MyPAYE), and monthly reporting period in others (Xero).

Change the report to pick up CIS Suffered from the beginning of the current reporting period.

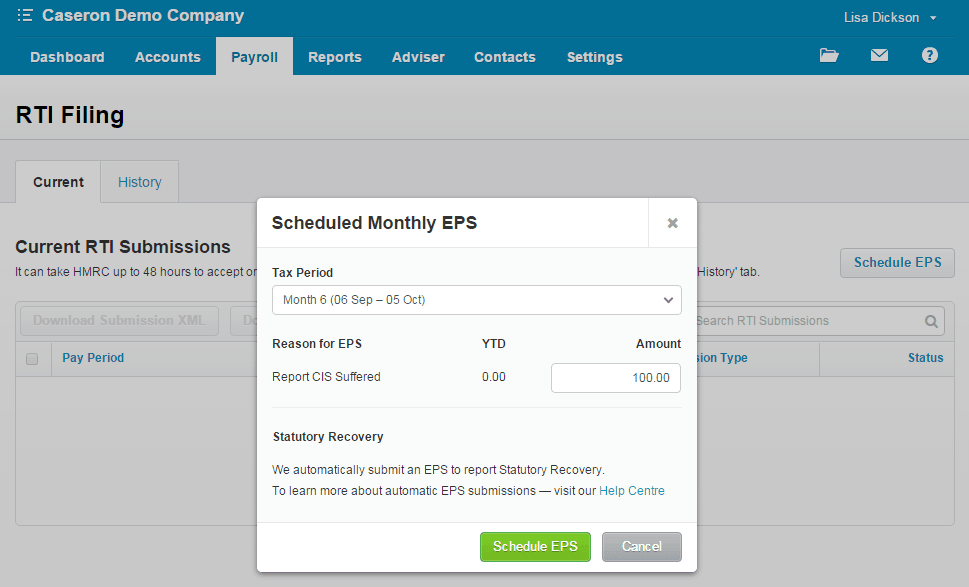

Then you can add that amount to your EPS and schedule it for filing.

Payroll >> RTI Filing >> Schedule EPS

Month end checks (or quarter/year end!)

At least annually – you should check that the amount showing as owed to HMRC in your balance sheet matches the amount that HMRC are showing online. If it doesn’t you can reconcile your account and track back any discrepancies.

The subcontractors’ supplier account

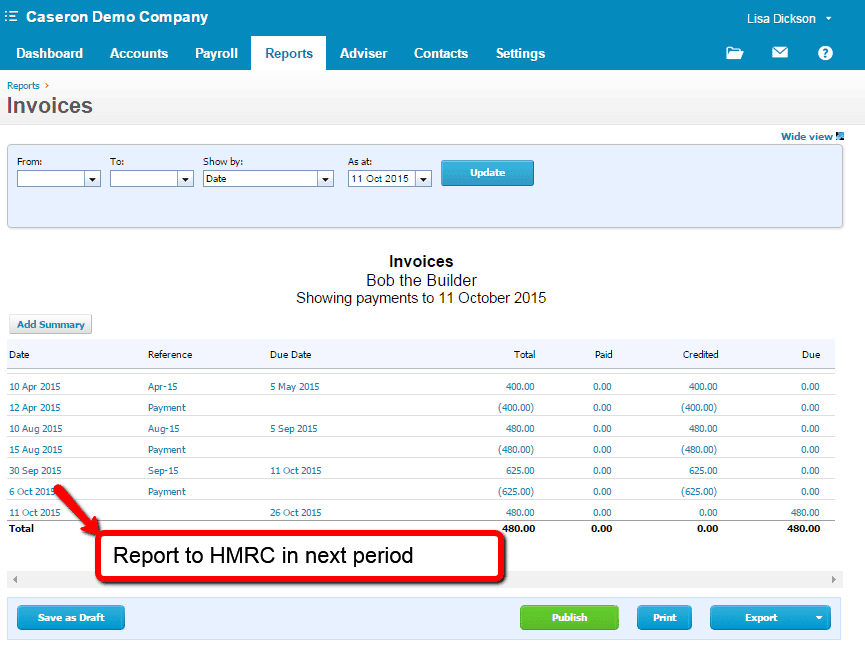

We like to see the full transaction history of costs incurred, payments made and amounts still outstanding to each subcontractor.

In Xero, it is possible to see the full audit trail of payments made to a supplier by posting payments as overpayments and then matching to the invoice being paid. It takes a little longer to record the transactions relating to CIS contractors in this way, but shows that the payment of £625 was paid on the 6th October meaning that it should actually be reported in the next period.

You can also see that we have received another invoice from Bob on the 11th October that has not been paid yet.

Payment and Deduction Statements

You are required to issue payment and deduction statements to your subcontractors within 14 days of the period end, ie the end of each month.

You will find a link to HMRC’s prescribed format here. Payment and Deduction statement format.