Updated 2023/24

It is simply an account in the balance sheet that summarises the transactions between a company director and the company.

In simple terms:

- An asset is created where the company loans money to the director to be repaid at a later date.

- A liability is created where the director lends money to the company to be repaid at a later date.

Directors’ loan account or DLA

A director’s loan account is sometimes referred to as a director’s current account. For the purposes of this article, we will use the term directors loan account or DLA.

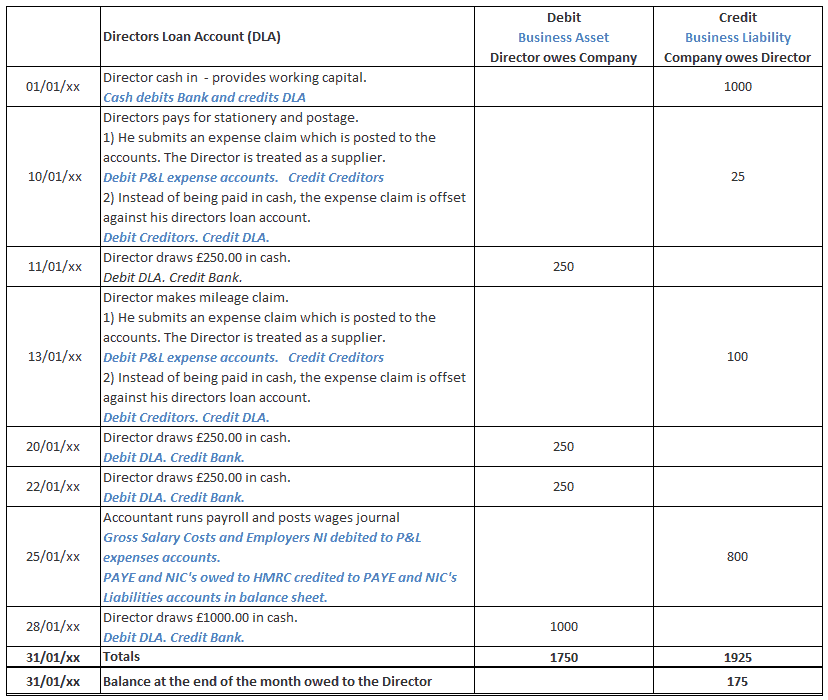

Cash in, cash out

The DLA is a combination of (cash in) money owed to and (cash out) money owed from the director. For example:

- the director may loan the company £1000 to pay a supplier or cover working capital requirements

- he may also pay for several items of stationery and postage on behalf of the company using his own cash

- he may later submit a mileage claim for business miles travelled in his own car

Each of these could be offset against the DLA. The directors’ loan account builds up an amount owing to the director that he may claim as and when he needs to.

Director’s salary

It is also quite common for directors to be paid a basic directors salary which is also offset against a directors loan account further increasing the amount owed to the director.

The director may not be paid his expenses or the actual net salary amount as they fall due but may again offset them against his directors loan account.

Directors will often draw irregular cash sums against the DLA in advance of wages being calculated and dividends being declared. These will be posted to the directors’ loan account to reduce the amount owing to the director.

Directors’ Loan Account transactions

Let’s look at an example:

Overdrawn directors’ loan account

Directors loan accounts can spiral out of control or if not checked regularly and managed carefully. By this, we mean that it’s very easy for a director to draw far more than he is entitled to resulting in an overdrawn directors loan account.

This can have serious tax implications at the end of the year – if you have drawn more than you should HMRC will consider that you have received the benefit of an interest-free directors loan.

If the overdrawn loan is not repaid within nine months of the end of your corporation tax period – the company will be charged an additional 33.75% (from 6th April 2022 onwards) in S455 Corporation Tax on the balance of the outstanding loan. The purpose of this additional tax is to discourage the misuse of company funds.

Directors loan accounts can only be repaid in three ways:

- Cash repayment –the director can simply repay the overdrawn loan balance in cash. He can also offset any unpaid expense claims, mileage claims or work from home allowances.

- Dividend –if the company is the sufficiently profitable and assuming the director is also a shareholder it may declare a dividend to clear the balance of the directors’ loan account.

- Payroll – if the company is not sufficiently profitable to declare a dividend and the is director does not have the cash to repay the overdrawn loan account then it may be possible to pay a bonus though payroll and offset this against the directors’ loan account. Be sure to pay the resulting PAYE and National Insurance due on the directors’ bonus.

S455 corporation tax

If the director is unable to pay down the directors loan account, then the additional corporation tax must be paid to HMRC. This is calculated and included in the Corporation Tax return. If the directors loan account is paid down in a future corporation tax period – then the S455 corporation tax charge is reversed and repaid or offset against the corporation tax liability in the future period.

Common errors accounting for the directors loan account include:

- Treating directors cash withdrawals as drawings. Directors of limited companies cannot take drawings in the same way that a sole trader or partner can or from an unlimited company. Limited companies are entities in their own right which means that the cash assets of the company belong to the company and not to the director. The director may borrow cash but must repay any borrowings or offset them against amounts legitimately claimed against the company.

- Treating directors cash withdrawals as expenses.

- Poor record keeping – miscoding of expenses and cash withdrawals which means that the loan account is much higher than you think it is or want it to be.

- Letting the loan account spiral out of control meaning that it’s impossible to clear at the year end resulting in the additional 33.75% corporation tax charge.

Keep you accounts up to date and learn to read your balance sheet so you can understand when your directors loan account becomes overdrawn and you are at risk.

- Raising invoices for directors loan account transactions. Cash in or cash out from the director is a simple spend or receive transaction and does not usually need to be accounted for by invoice. Invoices are usually only provided by trade suppliers to the company. A directors expense claim may be billed to the company by way of an invoice, costs charged to the profit and loss account and the invoice may be paid off against the directors loan account.

Caseron Masterclasses

If you'd like to take a deeper dive into this topic, take a look at our bloody brilliant business masterclass and download.