The Employment Rights Act of 1996 states that an employee has the right to a written pay statement.

General pay statement rules

The statement must:

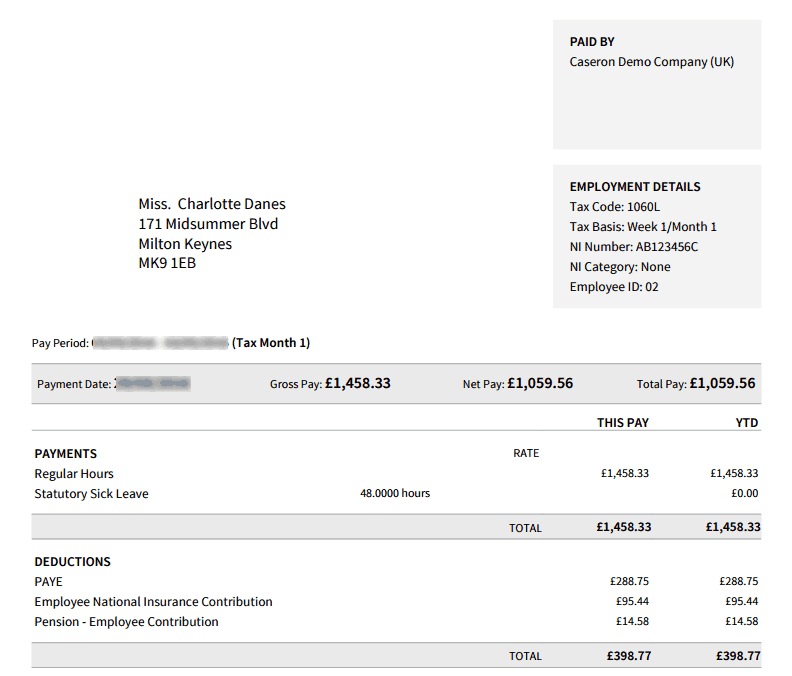

- show gross pay, all deductions and net wages payable

- be provided on or before payday

The employer must explain any fixed amount deductions such as a repayment of advance, deductions for absence or repayment of staff loans.

Fixed deductions ie. staff loans

Details of fixed weekly or monthly deductions can be provided on the pay statement or in a separate written statement. This statement must be issued with the first pay statement so the employee knows what will be deducted and when, and it must be updated each year.

Who does not get a payslip?

People who do not have a contract of employment and are therefore not an employee are not entitled to a payslip, i.e a contractor, freelancer or ‘worker’ who invoices you for work done

How should you provide the pay statement?

The law says that you must provide a written pay statement but the employer may decide if this is to be issued electronically or on paper.

Can an employee insist on a paper statement?

Technically no. Pay statements can be issued on paper or electronically, however, if the employee does not have an email account and cannot provide an email address, or makes it known that they cannot print an emailed payslip – you may wish to print and post it so that you are sure they have received a proper pay statement.