Common EU Suppliers

But what can you do when an EU supplier charges VAT on their invoices? The most common ones we see with our client’s accounts are Microsoft, Google Apps, Google Adwords and Facebook.

All of these suppliers are based in the Republic of Ireland which sits outside the EU and charge Irish VAT.

Can’t I just reclaim the VAT in my normal VAT return?

No! You can’t reclaim the VAT that you might be charged on EU suppliers back in your UK VAT return, even though you can see the VAT %, the VAT amount and the VAT number on the invoice. The invoice may look like any other UK supplier invoice but the supplier is outside of the UK so you can’t treat them in the same way.

So what do you do?

Don’t get charged the VAT in the first place!

If you provide your VAT number to an EU supplier, then they will zero rate your VAT and charge vat at 0%. Phew! You can usually log onto your account and check that the account is in your business name and your VAT number is registered.

If you are not sure if you are being charged VAT, then you’ll need to check your invoices to see if you are being charged or not.

Here are two examples:

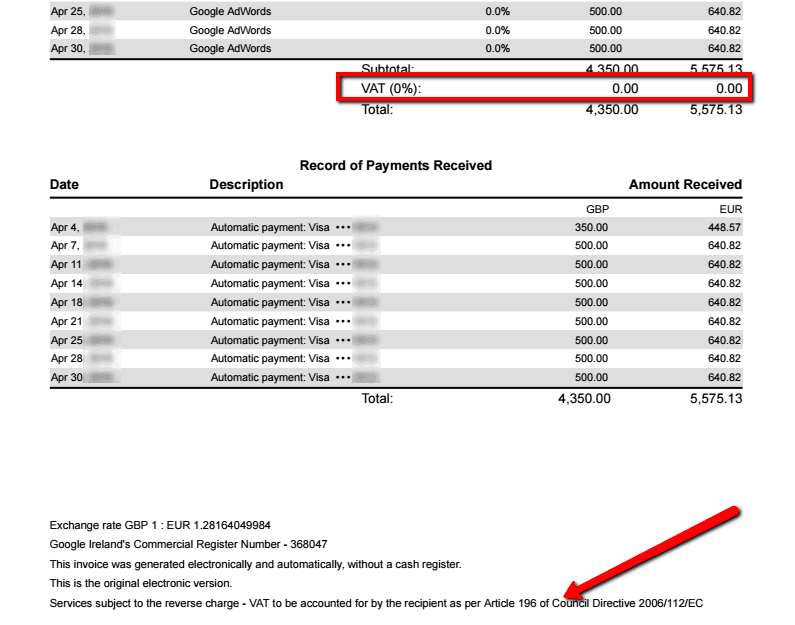

Google Adwords

Google Adwords is based in Dublin the Republic of Ireland. Their charges subject to reverse charge VAT if you have provided them with your VAT number. You can download the invoices for a couple of the transactions and check if you are being charged VAT or not.

A Google Adwords invoice will tell you that VAT is charged at 0% and that the services are subject to reverse charge VAT.

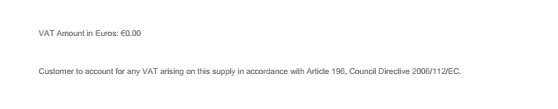

Facebook is also based in Dublin and will zero rate VAT on facebook ads if you have told them you are a VAT registered UK business. If you don’t know if you are being charged VAT or not, you’ll need to download an invoice and check.

- Facebook Ads and VAT – www.facebook.com/business/help/133076073434794

- Finding Facebook Invoices – www.facebook.com/business/help/190161391031782?ref=related

A facebook invoice will also tell you that VAT is charged at 0% and that the services are subject to reverse charge VAT.

And then there is Hootsuite!

Hootsuite are a Canadian company, but they are registered for VAT in the EU. They will treat you as a UK consumer customer unless you tell them otherwise. You can log on to your account and register your business name and enter your VAT number,allowing Hootsuite to zero arte their invoices to you.

- Hootsuite and VAT – https://help.hootsuite.com/hc/en-us/articles/205126640#13

- Updating Preferences – https://help.hootsuite.com/hc/en-us/articles/204596160-Update-Invoice-Preferences

Don’t forget to account for the Reverse Charge

You must then account for VAT in your business accounts under the reverse charge VAT mechanism.

The reverse charge is the amount of VAT you would have paid on that service if you had bought it in the UK.

Where it applies, you act as if you’re both the supplier and the customer. You charge yourself the VAT and then (assuming that the service relates to VAT taxable supplies that you make) you also claim it back. So the two taxes cancel each other out.

Fortunately, most accounting systems have a VAT code for the EC Reverse Charge and will take care of the accounting for you.

Why do we have to account for Reverse Charge tax?

Book A VAT Review

£120.00