The business is growing slowly but surely, you have a great sustainable and profitable customer base providing you with a comfortable income, good relationships with suppliers and a happy team working for you. You realise you are ready for the next step but realise that you don’t have the cash to fund it. Bank finance is scarce and your bank manager won’t increase your facility, so what are your options?

If you are considering any kind of finance please make sure you:

- Do your homework. Research your options and find the option that best fits your purpose.

- Never borrow more than you can afford to pay back.

-

ACTION: Do prepare a detailed and well thought out cashflow forecast.

- If you are financing a purchase, make sure there is enough margin in the sale to cover the borrowing fees.

-

ACTION: Do prepare a business plan – make sure you understand what you are borrowing, what it will cost and the return on investment to your business.

- Borrow over the shortest time frame possible, repay as quickly as possible. Invest the profits from the trade back into your business so it becomes self-funding.

We have come across some very interesting sources of alternative finance over the last few years, here are a few that you may not have considered already:

The Start-Up Loans Company  |

A government funded scheme to provide advice, business loans and mentoring to startup businesses. Available for businesses under 24 months old, run by people over 18 years old. The business must be primarily based in the UK. Personal loans for business purposes. One loan per person, but if there are 5 people in the business – each can have a loan.

Suitable for start up businesses looking loans of £500 – £25,000, with terms of 1-5 years and a fixed 6% annual interest. |

| Funding Circle

|

Funding Circle was created with a big idea: to revolutionize the outdated banking system and secure a better deal for everyone. Thousands of ordinary people and the UK government working together to lend money to British businesses.

For investors – You can earn a current estimated return of 6.4%* per year, back British businesses and set options to access your money early

Suitable for growing businesses looking for loans of £5,000 – £1M, with terms of up to 5 years. Fast funds and no early repayment fees. |

| EZBOB

|

Short term unsecured funding for any business purpose. Rates are determined by risk and credit rating. ezbob strives to provide the fastest service on the market funding on demand (once you have been approved of course).

For businesses – Loans of £1,000 – £120,000, with terms of up to 15 months. Fast funds and no early repayment fees. One click loans and online applications. |

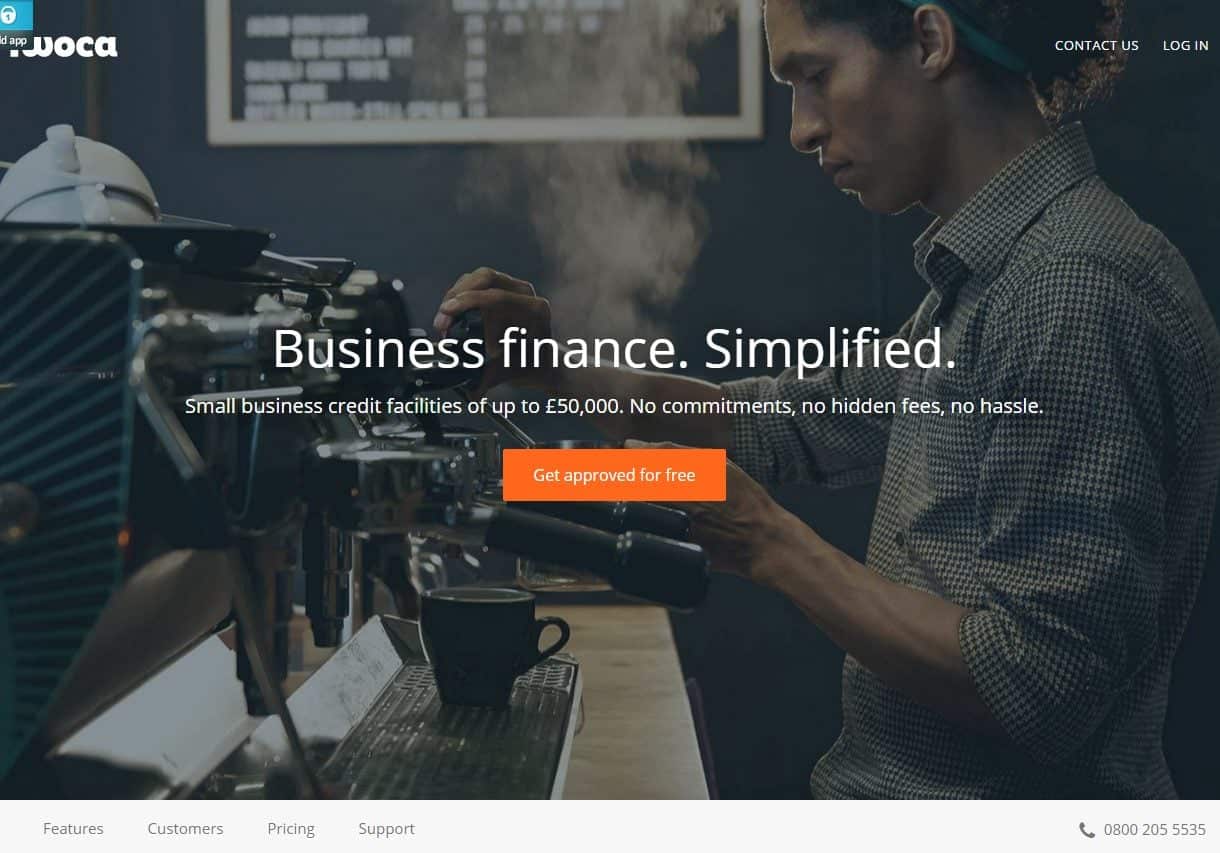

| iwoca

www.iwoca.co.uk |

Turn cash flow into a competitive advantage with revolving credit facilities, giving you access to £1,000 – £50,000 on demand at rates of 8-10% over 1-6 months. Once approved, you can draw down and repay as required.

No fees, interest charged on the outstanding balance.

Suitable for financing short term projects or financing specific purchases. |

| Crowdfunder

|

Reward based crowd funding, where people pledge money in return for rewards. The reward can be a product, service or experience that is produced by the project. Say a baker looking to fund a bakery swaps a loaf of bread a week in exchange for an investment in his business. Benefits include business validation, marketing (everyone shouts about it) funding of course and advocates. Often leads to match funding.

Fees are 5% of the project value, plus transactions charges – only payable if your project is successful.

Suitable for businesses looking to fund a modest project or asset purchase where the business is able to repay the funding with rewards rather than cash. |

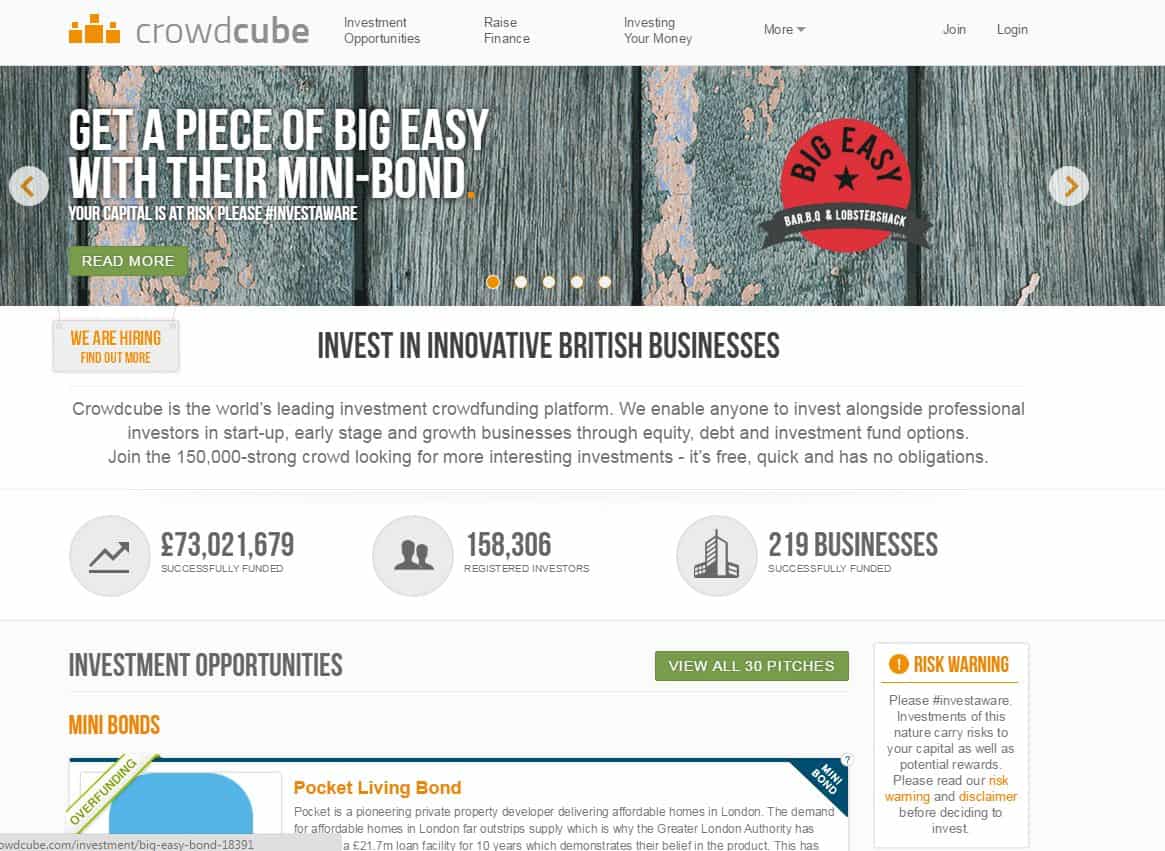

Crowdcube |

Crowdcube is the world’s leading investment crowdfunding platform. It is the largest network of angel investors backing British business and has raised over £70m from an investor community of 150,000+. Crowdcube enables anyone to invest alongside professional investors in start-up, early stage and growth businesses through equity, debt and investment fund options.

Suitable for ambitious businesses seeking growth, looking for loans of £20,000 – £several millions with flexible terms and rates. |

(Please note we are not advocates or agents for any of these schemes, the purpose of this article is to bring alternative sources of financing to your attention so you can investigate and consider suitability to your business and your future growth plans – we are not encouraging you to borrow money or rush out and lend any without doing the proper due diligence first!)