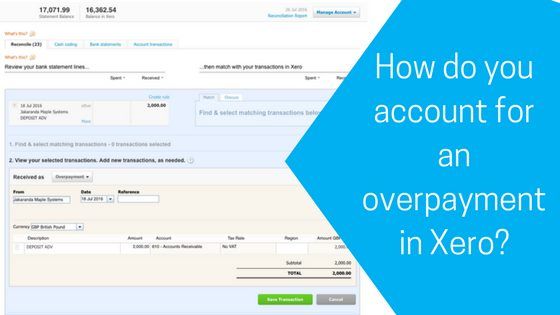

How do you account for an overpayment in Xero?

Despite our customers best efforts to pay what is due – you may have a customer who has accidentally overpaid you.

It may be that your customer pays you just a few pennies more than you’ve invoiced for – or they may have paid you hundreds more. How do you account for it?

Regardless of which accounting system you use – the concept remains the same, the only difference may be the terminology used. As we are Xero accountants, we will use Xero to show you what to do.

There are a few solutions for this, depending on the circumstances and desired outcome:

1. Adjustment – Match the payment any invoices and simply write-off the overpayment via an “Adjustment” – this often posts the transaction to the Balance Sheet in most systems. It will still need to be dealt with later on.

2 .Write Off – Match the payment any invoices and simply write-off the overpayment to a “Write off & small adjustments account” – posting the value directly to the Profit & Loss account as additional income

3. Overpayment – Post the entire value of the payment as a “Payment on account” on the customer’s record

Advantages and Disadvantages of each

| Method | Advantages | Disadvantages |

| # 1 Adjustment | Super quick and easy to post | Trickier to trace on the customer ledger

If a customer later requires a refund it’s trickier to action |

| # 2 Write Off | Easy to trace on the customer record

Easy to refund or write-off later Can be allocated against future invoices |

Trickier for the customer to understand on statements |

| # 3 Overpayment | Easy to trace on the customer record

Easy to refund or write-off later Can be allocated against future invoices Easy for the customer to understand on statements |

Takes a little bit longer to post the transaction |

Which one is best to use?

Small overpayments of a few pennies on invoices where you do not have an ongoing relationship can be written off immediately. Generally, your customer will not intend to reclaim this and there may not be any future invoices to set the overpayment off against.

If the values are larger then post the transaction as an Overpayment on the customer account to either refund or set-off against future invoices. Your allocations, refunds or write-offs can then be decided upon at a later date. The overpayment will display on the customer record which is particularly useful if your customer may be invoiced again in future.

!

|

|

| # | |

| 1 | Post overpayments as overpayments – it’s the most honest approach.

This gives the most clarity to both the customer and anyone carrying out credit control – especially useful if you have more than one person managing the accounts. |

| 2 | Don’t forget, exactly the same principles can be applied on a supplier account if you should accidentally overpay a supplier! |